Two days ago, Toys ‘R’ Us filed for Chapter 11 bankruptcy protection – mere weeks ahead of the critical holiday season – to restructure amid crippling debt, declining sales and relentless competition from retail powerhouses.

In recent years, Toys “R” Us has spent hundreds of million of dollars on interest expenses, which left few resources to fund its eCommerce website. By contrast, Amazon and Walmart dominate eCommerce due to a robust online presence, lower costs and fast home delivery.

Chief Executive David Brandon cited the immediate need for Toys ‘R’ Us to build inventory for the holiday season, which accounts for 40% of annual revenue.The retailer will also overhaul its web presence, digital customer loyalty program, ship-from-store capabilities and delivery time.

Babies ‘R’ Us brand to play a bigger role

Last year, baby gear accounted for 36% of Toys ‘R’ Us’ total U.S. revenue, so this category represents the company’s biggest share of domestic product sales. These results suggest baby products are the brand’s strength and core differentiator. As competitors Amazon and Walmart grow their market share in the toy category, Toys ‘R’ Us could benefit by focusing on baby products.

As such, Toys ‘R’ Us’ turnaround strategy will also involve investing $277 million from 2018 through 2021 to convert existing locations into side-by-side storefronts dedicated to toys and the Babies ‘R’ Us brand, as profits suffered in locations where Toys ‘R’ Us and Babies ‘R’ Us operate separately.

Emerging trends in the baby category

The baby products category has an estimated value of $30 billion industry and major recent category trends include:[v]

-

E-commerce share increase:

Online retail gained share points to account for more than 20% of baby product sales; Toys ‘R’ Us’ competitors Walmart, Target and Amazon all earned eCommerce share gains. This means Toys ‘R’ Us needs to focus more on its online business to avoid losing any more market share to online rivals.

-

Children in home don’t boost sales:

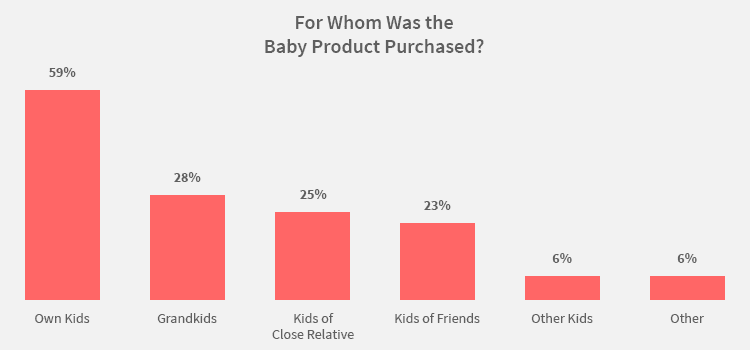

Surprisingly, having children in the home does not improve consumers’ odds of purchasing baby products, as 58% of buyers were households without children. This is good news, as Toys ‘R’ Us can expand its marketing campaigns to target doting grandparents, baby registries, relatives and friends of families with children – especially leading up to the holidays.

Shopping behavior within the baby category

To achieve a competitive advantage with baby products, Toys ‘R’ Us must understand the differences in shopping patterns within this category.

Overall, online retailers – including Walmart.com, Target.com, Amazon.com and Diapers.com – earned a 2% increase in share of mentions in most baby segments; meanwhile, specialty outlets, like Babies “R” Us, Toys “R” Us and department stores decreased. This means offering a robust, efficient online shopping experience must be a priority for Toys ‘R’ Us to keep up with the new retail reality that shoppers like to research products, compare prices and shop online.

Some distinctions within the baby category include big box and discounter rivals’ strengths. For instance, among diaper products, online purchasing share grew 2 percentage points, up to 22% in 2016. Target.com gained 1.1 percentage points in diaper sales at Target.com and specialty dropped overall by 2.3 percentage points with the biggest drop at Babies ‘R’ Us. Toys ‘R’ Us and Babies ‘R’ Us must consider shoppers’ needs: they may shop online because they don’t want to take their infant to the store, wait in line and carry big, bulky boxes of diapers to their car. Again, the eCommerce strategy must be a priority. While, it’s easier for people to buy diapers on a trip to the supermarket, it’s harder to draw them to speciality stores just for baby products. Now, were this to be moved online, things can get so much more convenient for targeted shoppers.

However, among baby needs products, which include shampoo, lotion, soap, powder and ointments, online sales grew 2.8 percentage points since 2016. Notable growth in this segment also took place among discount grocery retailers like Aldi and Save-a-lot. Toys ‘R’ Us should consider that value pricing and online convenience may be priorities for consumers of these types of baby products. What can set them apart are exclusive toy franchisee lines and novelty toy collabs that venture beyond the category to all baby-focused merchandise.

Capitalizing on a baby boom

Following yesterday’s announcement, Toys ‘R’ Us’ Canadian subsidiary announced it also plans to seek protection. However, the company’s other foreign operations, including more than 250 licensed stores and joint ventures in Asia, are not part of the Chapter 11 filing.

Earlier this year Toys ‘R’ Us invested in more physical stores in China and eCommerce operations, as the country’s market conditions look favorable. For instance, China eliminated its one-child policy, so more babies could mean more demand and sales for Toys ‘R’ Us’ baby products. In addition, the country has nearly half a billion middle-class consumers who are increasingly affluent, tech-savvy and willing to buy safe, quality products made overseas, making these shoppers ideal targets for the retailer’s omnichannel operations.

Wherever Toys ‘R’ Us operates in the world, if it focuses on the baby products market, the company must adapt to these emerging trends and shopping behaviors to better serve consumers and remain relevant in this fierce retail market.