And Why You Need Machine Learning To Tie Them All Together

We all know how important competitive pricing is in the online retail sphere. After all, the pricing successes of giants like Walmart, Target, and Best Buy has been documented time and time again.

And while lesser retailers strive for the same success, they rarely invest as much in price management solutions. Instead, they opt for the “tried and true” methodologies of yesteryear. A.k.a. Adhering to long standing traditions and unproven discounts.

… Hardly a formula for success.

However, Walmart didn’t arrive at the peak of the retail industry by guessing and checking. They arrived with a comprehensive price management strategy that enables dynamic pricing.

But you don’t need to be as big as Walmart to benefit from price management software. One study of thousands of Australian companies found that a proper price management infrastructure could increase long-term profits tenfold. And beyond the dollar signs, these businesses put themselves in a more flexible, agile position to deal with market turmoil and other risks.

In order to reap these benefits yourself, you need a pricing model that looks beyond the price. Here, we’ll discuss four major tenets of effective price management.

- Covering all your costs… And then some

Let’s imagine you’re launching a new product and working to pinpoint a worthy price. Your first inclination, naturally, is to weigh it against your costs: The price has to cover the product’s cost and bring in a profit on top of that.

But the reality is that there’s a laundry list of factors contributing to a product’s true cost. Production and manufacturing headline this list, followed closely by distribution. Then we also have to ask: What’s the cost of marketing this product? Or conducting ongoing research and development?

And the considerations keep going. For instance, what is the product’s “cost” in terms of how it affects other existing products? Does it eat into their share of sales? Does it have a widespread impact on current inventory turns? Or, on the flip side, will it relieve some of the marketing investment you put into those products?

Suddenly, we’re not dealing with a straightforward equation of “Price > Cost” anymore. As one article from the Harvard Business Review notes, “this is a circular problem that in theory can only be solved by simultaneous equations.”

And that’s precisely where price management tools come into play: To solve these simultaneous equations down to the decimal. They provide price management big data that allows us to predict costs with a high degree of certainty. That’s how we establish desired margins and realistic profit targets.

Naturally, though, your company’s products and internal operations aren’t the only concern…

- Keeping an eye on your competitors and feel for your market

We’ve written at length about the importance of competitor price monitoring (and the value of our competitive benchmarking tool)… And with good reason! Having accurate analyses of other brands in your field is a necessity for keeping up with your market.

That said, the issue of competitive price management is more nuanced than simply tracking and beating their prices.

You have to consider the inevitable fluctuation of demand: What’s a reasonable expectation of sales return for your product? How might different price ranges and pricing patterns optimize this return? For instance, a segmented strategy that offers distinct prices to different target audiences may be your best shot at competitive differentiation.

The small problem with competitive differentiation, though, is that your competitors are also working to gain it. Whatever measures you take, you can expect them to counteract. Meaning that in this constant pursuit of differentiation, you have to work to compete while weighing the risk of possible price wars (and the lose-lose race to the bottom they entail).

Plus, it’s not just your direct product competitors that you have to worry about; more indirect product substitutes are also trying to gain their market share. They may be even trickier to fend off, as the impacts of their pricing maneuvers often aren’t quite as immediately obvious.

Ultimately, it’s a continuous battle. You’re playing a chess game with countless players and with no bound to the possible number of moves. That’s why we like to think of price management AI solutions as your proverbial Queen — helping you move across your market chessboard with ease.

- Using your price to compel your customers

How do we make sure that the price is actually helping us sell?

That’s a question every retailer must ask, and it can be broken down into more specific questions. Namely: What price range is the target audience comfortable with? What is their price sensitivity?

The answer, of course, will differ from product to product, company to company, and industry to industry. And that’s without mentioning that price sensitivity isn’t a fixed constant; it may change for individual customers based on various factors (i.e. time of year).

Thus, you need a continuous effort to determine the effect your prices have on customer demand.

Perhaps you’ll find that demand is inelastic, meaning that customers in your target market are not extremely sensitive to price changes. This may be a strong testament to your products’ value, or your brand’s selling power, or even just the weakness of your competition. Regardless, this is an ideal scenario, allowing you to (carefully) raise prices and reap incremental revenue growth.

The other end of the spectrum is finding elastic demand, with an audience conscious of price changes. In this case, putting out a compelling price is a much more delicate affair. Slightly lowering prices may indeed prove to be a benefit… But that’s a dangerous game. The cycle of price reductions can harm the quality of your offering, cut revenue beyond repair, and damage brand reputation.

Regardless, the point is that finding where your customer demand lies on this spectrum is key to establishing your realistic price range. And this is where price management tools come into play. Because it’s all too easy to set this range based on flawed, internal perceptions of your customer base. But with a platform that integrates machine learning, you can comfortably avoid any implicit biases or unfounded assumptions that might cloud your team from seeing the full pricing picture.

- Capturing your brand identity and establishing your reputation

Effective price management isn’t about offering the lowest or highest price. It’s about offering the price that best supports your brand image.

Similar to the previous point, the key here is presenting a price the reflects the value of your product. Because your price is your most powerful marketing tool. It says more to your customers than any slogan, landing page, or email campaign ever will. So when it comes to price management, treat your prices as you treat these marketing efforts.

Now, what does it mean to frame a price to support brand identity? Well, it’s all about playing to the strength of your value proposition:

- If your unique selling point is “unparalleled savings” or “extreme efficiency,” low prices will likely bolster that image (think: Walmart’s “everyday low prices” or Aldi’s “brutal efficiency”)

- If your unique selling point is tied to quality, luxury, or prestige, lower prices will hurt your image and send some high-paying users packing. Whereas higher prices will reinforce the notion that your quality is worth the price (Wholefoods and Starbucks have made billions this very way)

- If your value proposition isn’t as directly tied to price — perhaps it’s creating a comfortable atmosphere (Trader Joe’s) or simplifying a headache process (TurboTax) — then the challenge remains: Find a sweet spot on the value/pricing spectrum.

To expand on that last bullet point, there are many ways that lowering prices can hurt even middle-of-the-pack brands. It can undermine your value proposition (even if you aren’t offering a luxury item) and weaken your brand image. And, from a profit standpoint, it can leave money on the table. Pricing down may shift you away from a higher-paying target audience without actually doing enough to entice budget-minded buyers. So, be mindful of customers’ general perceptions.

None of that is possible, however, without gathering intelligence and identifying pain points before even launching your product. Only through those means can you effectively position your product as the solution and cultivate a defined value proposition. And that’s why before every product launch, online pricing management calls for extensive market research.

Final word: The solution to the price management question lies in machine learning

This article is just the tip of the iceberg of factors that play into a price management strategy. The nuances of these factors (and others, like a product’s timeline) are numerous and often fluctuating.

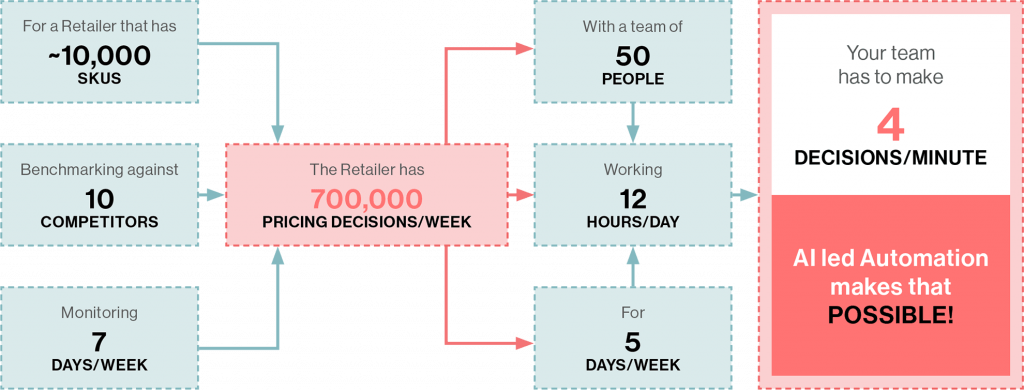

So how do we keep our finger on the pulse of our market? When there’s too much to take into account and everything’s always changing?

With machine learning, Modern price management tools enable real-time adjustments based on product histories, current realities, and future projections. They empower you to use accurate price comparisons to establish dynamic pricing models.

Ultimately, they take the behemoth that is price management, and they transform it into something easily digestible. So that what you’re left with is a direct path to competitive differentiation.