As we have welcomed 2018, it’s the perfect time to meet the new face of retail. Digital media services – for online access to music, TV and video – have evolved as powerful products in their own right, hypnotizing consumers with their convenience and cost effectiveness, and earning a spot in their hearts and wallets. Digital services have exploded as mainstream products that young shoppers have come to expect, and which now claim impressive chunks of retail revenue.

First, a quick history of the evolution of music in retail:

- Physical stores: Until the late ‘90s, music lovers had to shop in brick-and-mortar stores to buy physical forms of music, such as CDs, cassettes and records.

- Online piracy: In 1999, digital disruptor Napster changed that. The peer-to-peer file-sharing site allowed music lovers to illegally download songs for free from their computer.

- Industry chaos: Between 1999 and 2014, record label revenues fell 40% due to online piracy, which led to physical sales declines and record store closures.

- Legitimate online downloads: The music industry scrambled to stem the flow of revenue and innovative companies stepped in by offering download services (e.g. Apple’s iTunes)

- Online streaming explodes: Now music lovers can pay a monthly subscription to stream music wherever they are from the convenience of their mobile device (e.g. Apple Music)

Streaming Services Saved The Music Industry

Last year, the music industry recorded its second year of growth due to global mass adoption of streaming. For the first time ever, streaming music services accounted for more than half (51%) of the U.S. music industry’s revenue in 2016, totalling $3.9 billion – up from 34% the previous year.

More than 30 million people now pay for a subscription streaming service in the U.S., and streaming accounts for 62% of the U.S. music business. Strong growth of paid subscriptions for services like Spotify and Apple Music more than doubled revenue from paid subscriptions in 2016, accounting for $2.5 billion.

Globally, an astounding 112 million paying subscribers use services like Spotify, Apple Music and Tidal, boosting revenue growth by more than 60% last year. That’s because, “music has been one of the fastest adapting sectors in the digital world” since music is so primal that our desire for it transcends cultures and geographic markets.

Paid subscriptions have earned such impressive sales because they address consumers’ desire for fast service with their immediacy, which saves them time, as well as easy access to a wide variety of entertainment options.

By contrast, digital download revenue fell more than 20% and experts expect this format will go extinct in the next few years due to the popularity of digital services. Meanwhile, iTunes-style digital download sales declined 24% because, as one expert explains, “why buy songs for a dollar when you can legally stream (almost) anything you want for a price that ranges between zero and $10 a month?

Streaming has even created new type of piracy – stream ripping, which involves stealing audio or video streams. Experts say 46% of 16-24 year olds had illegally ripped songs from YouTube or streaming sites.

How Apple and Spotify Shape Buyer Behavior

Apple’s App Store has evolved into the new frontier for retail consumption. While it represents only 13% of Apple’s revenue, it is the only major segment of the company’s business that grew in the last quarter of 2016.

In Q1 of this year, Apple’s Services business earned $7 billion in revenue. As CEO Tim Cook stated, “it’s well on the way to being the size of a Fortune 100 company,” as Apple Services dwarfs tech rivals’ services like Netflix and Amazon Web Services.

As Apple Services grows, it offers the tech giant a consistent source of recurring revenue through subscriptions, and helps to sell more Apple products by integrated hardware, software and services for up-selling and loyalty.

Similarly, Spotify is also disrupting the industry with its music, podcast and video streaming service. The company is on track to end 2017 with 70 million paying subscribers, 160 million total active users and $5 billion in annual revenues. Compared to competitor Pandora, Spotify offers greater variety and fewer restrictions, which makes the customer experience more seamless and rewarding.

Evolving From ‘Free’ to ‘Get’: Apps As Commodities

To maximize revenue with value-added offerings, digital services also offer in-app purchases of premium content. For instance, Amazon Prime Video offered live streaming access to the recent Ultimate Fighting Championship (UFC) match featuring middleweight superstar Georges St-Pierre’s triumphant comeback – for an additional charge. Competing digital services companies also offer premium upgrades for exclusive content for pay-per-view and subscription options.

According to recent research, app purchasing occurs frequently, as 34% of respondents had purchased an app in the past 7 days, and 73% of respondents had purchased it in the past month. In-app content, accounted for 17% of purchases yet it continues to grow, and the median price in-app purchases is $5 among U.S. consumers.

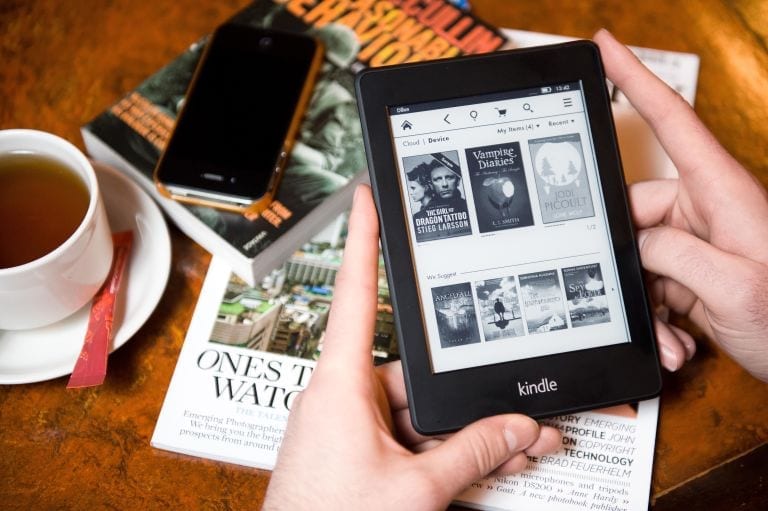

Kindle Makes You Buy More Books Than You Would’ve In A Bookstore

When Amazon book lovers take up digital readership, they tend to read four times more e-books than they read physical books (based on Amazon’s sales of physical books). Offerings from audiobook brand Audible and Amazon Prime have upended the publishing industry with their variety, ease of access and cost savings. Amazon has evolved into the primary online destination because it is the biggest bookstore in the world.

Online book sales have skyrocketed in Asia. Last year, India and China together surpassed the U.S. as the biggest market for Amazon’s Kindle e-book reader. While Amazon’s U.S. customers read four times more digital books than they read physical books, in India, Kindle users download 10 times the number of books they buy in physical form.

Total e-book sales as a percentage of physical book sales for Amazon India grew from 56% in January 2015 to 86% in December 2015.

The Future Seems Bright

The ease and convenience of integrated functionality have made digital services so appealing. For instance, smartphone users appreciate the seamlessness of using their mobile wallet, such as Apple Pay, integrated into their iPhone to make it easier and faster to access and pay for their Apple Music subscription.

As a result, digital services revenue has started to erode revenue for such physical products as CDs and TVs. Revenue from physical formats declined nearly 8% last year; however, in markets like France, Germany and Japan, 70% of profits still come from CD and record sales.

Revenue from music and video streaming services, like Netflix and Spotify, will surpass retail in the entertainment market for the first time this year. In 2017, 60% of entertainment spending will take place on streaming (vs. 5% in 2012).

As music downloads declined, Apple launched its own streaming service, Apple Music, in 2015. Last year, Amazon launched Amazon Unlimited, and Disney introduced the Disney Life service in 2015 and will add ESPN next year. Increased competition has led to longer free trials, exclusive content and greater content variety, which has grown the market by attracting more consumers to streaming services.

For their convenience, cost savings and customer-centricity digital services appear to be on track to continue to resuscitate the music industry and reinvent consumer behavior by making streaming TV and videos irresistible.

This is part 3 of our content series about factors that make people spend more.

Part 1 of the content series lies in the identification of the factors that make you spend more than you intended to, and what online retailers can adopt for a similar effect.

Part 2 talks about “5 tools to get shoppers to spend”.

We can help you with our “Assortment Intelligence”, you will feel certain, confident and clear about what shoppers want. Informative big data insights show you emerging retail trends and patterns so you adjust to consumer preferences. Get a free demo!