Counterfeit products, representing nearly 3.5% of world trade today, are flooding the market and COVID-19 has exacerbated this problem for brands, manufacturers, and consumers. Counterfeit products accelerate price erosion and damage brand image, making it difficult to secure good margins and risking further deterioration of consumer trust.

With the alarming growth of this counterfeit threat, brands and manufacturers cannot sit on the sidelines and hope for this issue to resolve itself. They need to come together to fight this challenge and educate consumers about the ills of this industry.

Here are some key insights from a recent consumer counterfeit survey conducted by Intelligence Node and best practices to combat this problem:

- 1 in 4 shoppers has encountered a rise in counterfeit products online since the start of the pandemic

COVID-19 disrupted the retail ecosystem and strained eCommerce sites early in the pandemic. With the ensuing lockdown, there was a sudden demand surge for essentials which opened an opportunity for counterfeits to enter the eCommerce space. As a result, 26% of the shoppers said they encountered an increase in counterfeit items since March 2020 while 39% thought they haven’t seen any increase. Another 35% were unsure of the rise in counterfeits or failed to notice any difference.

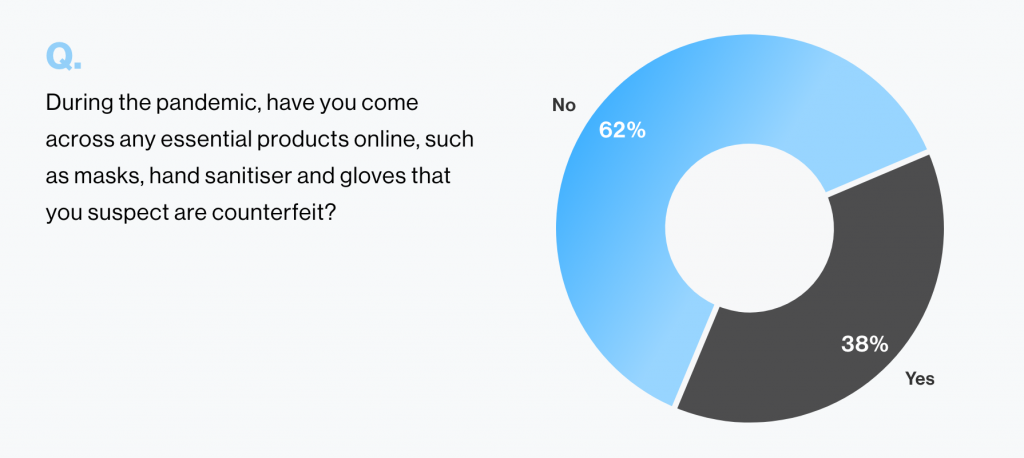

- Nearly 40% of shoppers came across counterfeit essential items online during the pandemic

38% of shoppers thought they saw a rise in counterfeit essential items like masks, sanitizers, and gloves, during the pandemic. Also, almost 1 out of 4 consumers said they purchased such counterfeit essentials online during this time. These findings show that along with other retail concerns, the disruption caused by the pandemic opened doors to counterfeit essentials, which are now eating into the margins of brands and retailers.

Majority of the consumers believe eBay sells the most counterfeit products amongst online sellers

According to 80% of respondents (up by 4% since March), eBay sells the most counterfeit products followed by Amazon with 53% of votes. This finding indicates that consumers’ trust in eBay has further dwindled. Infact, 26% of shoppers said they have stopped buying on eBay out of counterfeit concern, which is a sign of consumer distrust and a diminishing reputation. With the growing cases of counterfeits on eCommerce marketplaces, brands like Nike have started to pull out of these marketplaces. To maintain brand image and consumer trust, large players like Amazon and eBay need to take the lead and monitor any suspicious activity closely and penalize and ban vendors identified for selling counterfeits. They need to regulate and verify all vendor listings and encourage verified consumer reviews to eliminate counterfeits from their platforms.

- Price is the #1 reason why 53% of consumers bought counterfeit products

14% of consumers have intentionally purchased counterfeits and more than 50% of the consumers who have bought counterfeits cited price as the main reason. We attribute this finding to the economic instability of the current market – simply put, consumers are opting for counterfeit products to save money.

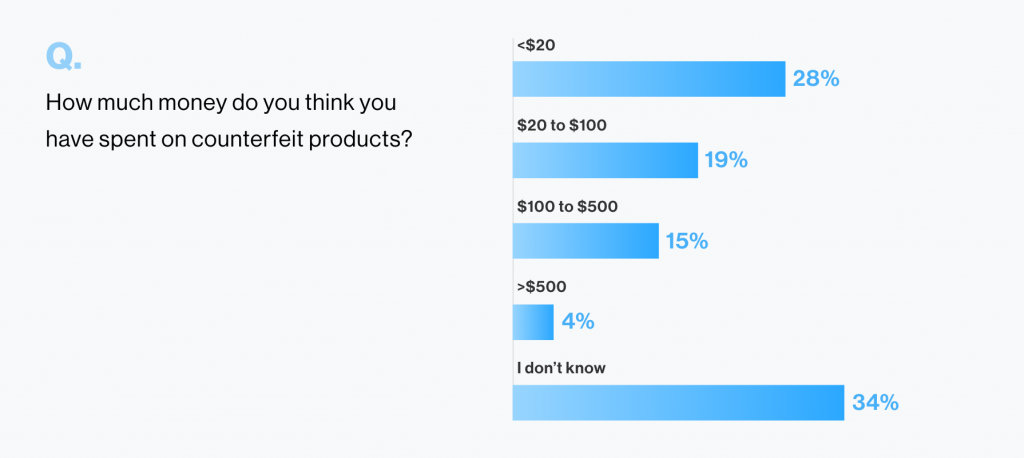

- Nearly 50% of shoppers have spent $20 or more in counterfeit purchases

In total, nearly 50% of consumers have purchased $20 or more in counterfeit products. Our September survey indicates that of consumers surveyed, 4% have spent $500+, 15% have spent between $100-$500, and 19% spent between $20-$100 on counterfeit products. These percentages applied across the entire buying ecosystem can equate to hundreds of thousands in lost revenue for authentic brands and retailers.

- 1 in every 2 respondents think counterfeits are most prominent with luxury brands, Louis Vuitton & Gucci

According to respondents, Louis Vuitton and Gucci are most susceptible to counterfeit goods. This finding reveals that the two luxury brands must do more to win consumers. And, as the reputation of these brands degrades, the larger risk to the luxury brand market is that a segment of consumers may never return to buying authentic brands.

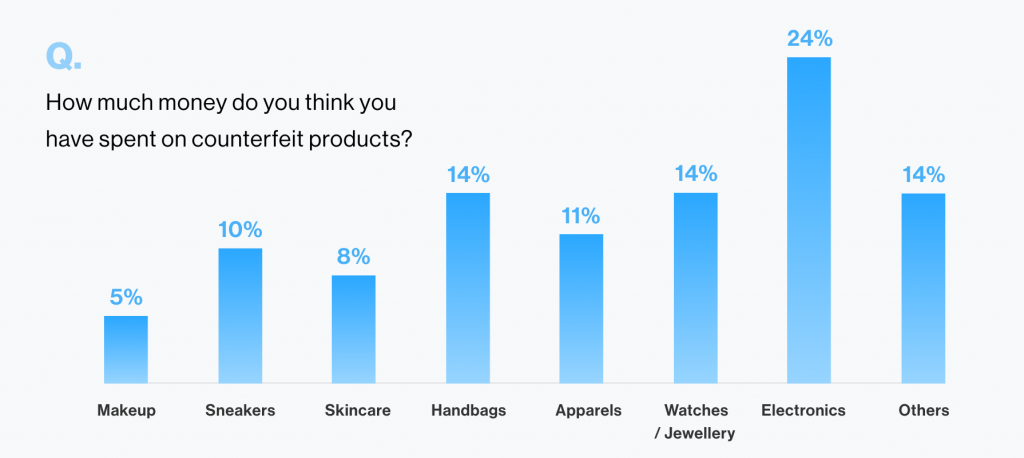

- Consumers are concerned about buying electronic counterfeit products

When asked which category they were most concerned about buying counterfeit products, consumers overwhelmingly stated electronic products. We saw a similar pattern in our March survey as well, highlighting that this segment remains at the forefront of consumer concern. This trend also shows that consumers want to avoid purchasing fake electronic products. Brands, therefore, have an opportunity to really squash counterfeit buying in their segment.

Protect Your Margins, Act Now!

Brands, retailers, manufacturers, and consumers, are all affected by the counterfeit market and need to work in unison to fight this crisis that has been thwarting the evolution of the online retail industry.

Although stopping the unrestrained growth of counterfeit products seems like a difficult challenge, sophisticated AI-driven tools and technology along with strict regulations can help stop and reverse the growth of this industry.

Follow These Best Practices to Impede the Growth of Counterfeits Market:

- Ensure your Intellectual Property is registered and trademarks are labeled.

- Identify counterfeit products and where they are being sold.

- Use eCommerce anti-counterfeit tools like Minimum Advertised Pricing (MAP) Monitoring to detect prices in real-time.

- Invest in anti-counterfeit packaging technology.

- Deploy strict brand guidelines.

- Partner with regulators and trade associations for better e-governance regulations.

- Pressure large eCommerce marketplaces into better-regulating products and merchant listings.

- Leverage smart pricing solutions to offer competitive prices.

Tackling this problem together is the only way to put an end to counterfeits, and brands, manufacturers, and governments have started to move in this direction with new e-governance laws, anti-counterfeit legislations and better utilization of available technology.

Want to access the full survey results and analysis? Download the Free Ebook Now!